Further exploring the Integrated Stakeholder Ecosystem (ISE), the next stakeholder group to look at in more detail are Investors. So what best practice can we see in the market today related to this group?

First of all, lets look at investors. What do some of the Firms of Endearment and other companies experiencing high growth do differently in regards to their investors? First of all, the type of investors they seek and brig on-board has changed. The focus shifted from considering solely third party investors, being usually the wealthy and privileged angel investors, other organizations or VCs to combining such bigger investors with “in-house” investors.

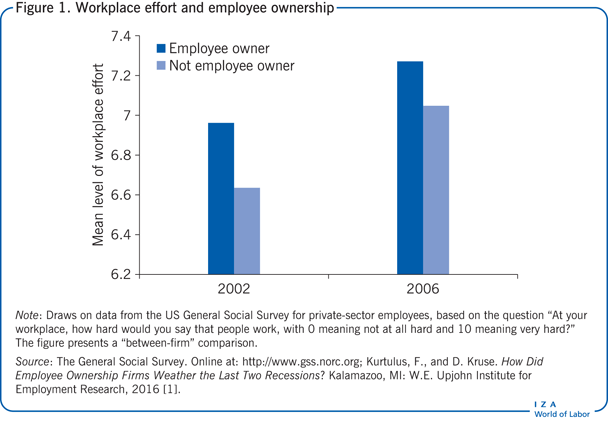

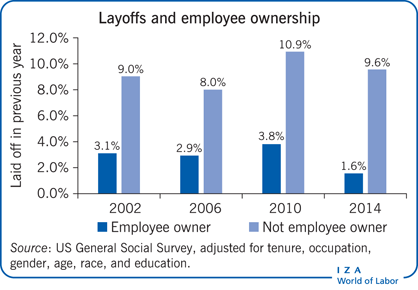

We see more and more companies turning their employees, managers, or even their loyal customers into stockholders. They are aware of the fact that these investors are more emotionally invested and aligned with the company, its values and purpose, and will more likely stick around longer and stand by them even in times of crisis. In addition the “in-house” stockholders get more ownership, empowerment and focus toward achieving company growth, being hungry for success and increasing the earnings per share (EPS).

Interesting are the two graphs related to employee ownership, being the result of a US-based research done by IZA, World of Labor. They show employee ownership generally increases organization performance and worker outcomes and that employees owning stock, get less laid off.

Reflection time:

- Who are your current investors?

- Do you sit on your equity or offer employees, managers or your customers to own your stock?

- What if your preferred investor category and why?